50-30-20 Rule: Smart Saving and Building Capital.

|

| 50-30-20 Rule: Smart Saving and Building Capital. |

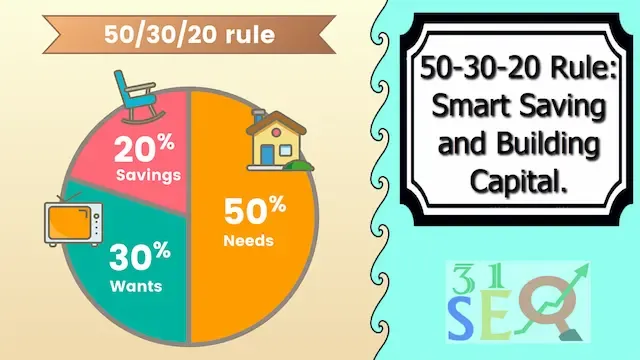

What is the 50-30-20 Rule?

The 50-30-20 rule is a simple formula to save money and build capital, regardless of income level. The available net income is divided into three different expenditure and saving areas.- 50 percent for fixed costs and basic expenses

- 30 percent for leisure and personal needs

- 20 percent for savings and debt repayment

50-30-20 Rule: How Should I Divide My Salary?

According to the 50-30-20 rule, you structure your net income as precisely as possible into the three categories. The following list shows which costs fall into which area:Fixed Costs (50 percent)

The largest portion comprises basic expenses that occur every month. They finance (over)living. These primarily include:- Rent

- Electricity and gas

- Insurances

- Contracts for internet, TV, phone, and smartphone

- Groceries

- Fuel

Personal Needs, Leisure, and Desires (30 percent)

These costs are not essential but cover personal needs. They are expenses for leisure activities and participation in social life. They are also called leisure expenses or lifestyle costs. These include:- Restaurant visits

- Travel

- Shopping and clothing

- Cultural activities

- Hobbies

- Vacation

- Entertainment electronics

Savings Share (20 percent)

20 percent is not spent on consumption but goes into savings. The third portion according to the 50-30-20 rule can serve various purposes:- Debt repayment

- Saving and capital building

- Investment in stocks or ETFs

- Emergency fund

- Private retirement provision

- Preparing for a property purchase

Example Calculation for the 50-30-20 Rule: $2000 Net Income

This example demonstrates the effectiveness of the 50-30-20 rule. With an assumed net income of $2000 per month, the budget allocation would look like this:- 50 percent for fixed costs: $1000

- 30 percent for personal expenses: $600

- 20 percent for savings: $400

How much to save with a $3000 net income?

As net income increases, the amounts for the different categories adjust accordingly. With an income of $3000, the savings portion becomes $600 monthly. Although this sounds like a lot, the percentage distribution remains unchanged. Thus, you have $1500 available for fixed costs and can plan $900 monthly for leisure expenses and personal needs.50-30-20 Rule: Experiences and Reports:

Experiences with the 50-30-20 rule are very positive. Numerous testimonials indicate an improvement in personal financial situations. A major advantage is the ease of application. The concept is easy to understand. After initial organization, it is possible to allocate costs to the three areas without much effort.Of course, there are also criticisms. Especially with a small budget, implementation problems are reported. With only $1200 a month, many find it difficult to use $240 as a savings portion.

Why does the 50-30-20 rule work?

The 50-30-20 rule works through consistent and disciplined allocation of income. You use your money wisely for different areas: securing your standard of living, allowing yourself some treats, paying off debts, and building capital. The guideline also reveals where you might be living beyond your means. Too expensive an apartment? Too much shopping? The 50-30-20 rule forces reflection on your expenses. Anyone who wants to save capital for the future cannot avoid cutting back on consumption in the present.Tips for the 50-30-20 Rule:

After so much theory, it gets practical now. For the rule to work, you ultimately need to review your fixed costs and expenses for savings potential. This can be achieved with the following tips:Reduce Fixed Costs:

Regularly check your basic expenses. Can you afford your rent? Is there a cheaper provider for electricity or gas? Are all insurances necessary? Use consumer and comparison portals like Check24 or Verivox. A separate household account to which you transfer 50 percent of your income via standing order can be helpful. It is important to differentiate exactly between basic needs and expenses that enrich life but are not necessary.Keep a Household Book:

You get a good overview if you keep a household book. It records current and future expenses. This way, changes (compared to previous months) can be controlled, and the budget can be planned. Budget-savvy people will also discover some savings potential.Plan Expenses in Advance:

Some expenses come unexpectedly, but many can be anticipated. The fridge is ten years old, and the car is sputtering. Plan such expenses early. Set aside a specific amount from the savings portion or reduce personal expenses for a while to have additional money available.Build an Emergency Fund:

Long-term investments and returns are an important part of the 50-30-20 rule. Initially, however, the focus should be on building a financial emergency fund. Rule of thumb: Set aside enough money to cover ongoing expenses for three to six months. This prepares you for emergencies and provides a financial cushion. Set up a standing order to a savings or daily money account until your emergency fund is reached.Avoid Exceptions:

Do not make exceptions to the 50-30-20 rule. Your net income is divided into the categories. This also applies to Christmas or vacation money. If you keep making exceptions or shifting the boundaries, the system cannot work.Maintain the Savings Rate:

A common mistake: when there are budget problems, the savings rate is reduced. Instead, question the other costs. This may mean a small cut or a loss of quality of life, but in the long run, you will achieve financial freedom. Don’t save on savings!50-30-20 Rule: Financial Planning App

You can further optimize your financial planning according to the 50-30-20 rule with the help of financial planning apps. You can find suitable programs in the App Store. Well-known examples are "MeinBudget," "Moneywyn," and "Mint.com." There, you can even enter expenses for each family member separately into the categories of fixed costs, personal expenses, and savings portion. It shows you which portion makes up what percentage and whether you adhere to the 50-30-20 rule.

50-30-20 Rule: An Alternative to Saving

The 50-30-20 rule is a widespread and popular option for financial optimization and long-term wealth building, but it is not the only option. Various alternatives bring order to financial chaos with different expense categories or other distributions. What almost all of them have in common: fixed savings and investment rates are essential.In other words, money must be left over at the end of the month. If you use up all your income, nothing will be left in the long run. Then there are only two options: increase earnings or reduce expenses.

60-30-10 Rule as an Alternative

An alternative that is similar to the 50-30-20 rule is the 60-30-10 rule. Here, you divide your salary into three different accounts used for different purposes.1. Consumption (60 percent)

The majority of your income goes towards consumption. This part includes all monthly fixed costs, as well as additional expenses for leisure or other purchases. From this account, you pay all ongoing costs and cover your living expenses.2. Investment (30 percent)

A relatively large portion of 30 percent is reserved for investments in this concept. This includes direct financial products and investments in stocks, as well as personal development to expand your skills and knowledge.3. Savings (10 percent)

According to the 60-30-10 rule, the last ten percent is your savings rate. You set aside this portion for short-term emergencies and build up the aforementioned emergency fund.The advantage of this method: you invest a large part of your income and can make significant investments over several years. However, it has a major drawback: you only have 60 percent of your income left to live on.